9 Reasons Why an Appeals Process is Needed

There is no doubt that suffering an injury or illness that requires a trip to the ER is stressful. Still, it can become a nightmare when your insurance provider decides to deny coverage of treatment received in the emergency room.

Fortunately, the law is on your side. There are effective ways for asking the insurance provider to reconsider their decision and honor their coverage agreement.

What is Health Insurance Denial?

Suppose you suffer an accident or sudden illness and need to go to the ER, and you use your health insurance to help cover the costs. In that case, the healthcare facility will prepare a claim on your behalf detailing the treatments provided during your visit.

An insurance denial happens when your health insurance provider notifies you that they won’t cover the cost of your ER visit.

This is frustrating and scary as it potentially means you will have to pay the total cost of the treatment out-of-pocket.

However, there is no need to panic, as you can submit an appeal.

What is an Appeal?

Appealing means formally asking your insurance provider to reconsider its decision to deny paying for the medical services you received while in the emergency room.

You should know that you have a legal right to appeal an insurance denial. It’s no secret that insurance companies care more about their bottom line than the people they insure.

Therefore, it’s not uncommon for these companies to deny medical care payments or try to charge you out-of-network rates for emergency care services, which is illegal.

Additionally, many insurers try to complicate the appeal process to discourage patients from trying to rectify a wrong. The good news is that you don’t have to go through this process alone. Our patient advocate is here to help you submit an appeal and fight the insurance companies on your behalf.

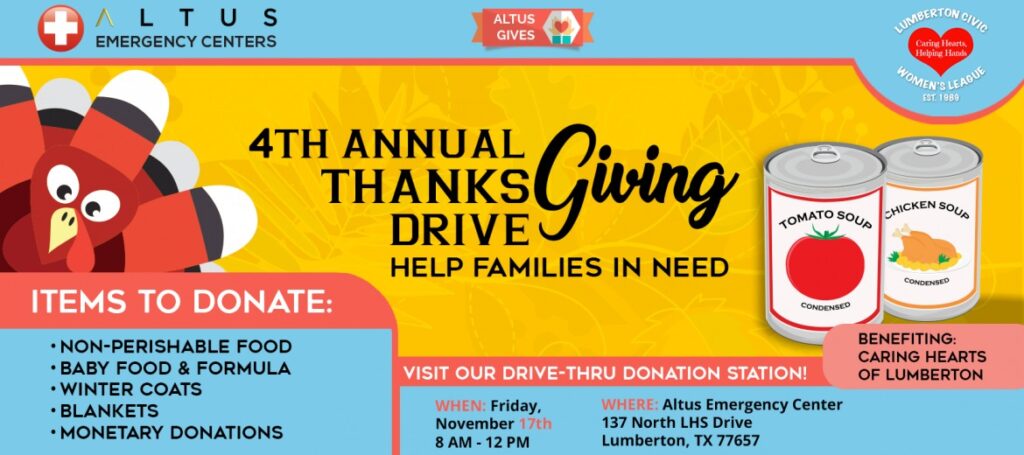

Know Where to Go in Case of an Emergency.

Why is An Appeal Process Necessary?

Here are nine reasons why an appeal process is required:

- When the Insurance company processes the patient’s ER visit as an Out of Network Provider instead of an ER visit

The insurance must process the claim as an Emergency Room visit. They can’t just process it as an out-of-network provider.

Insurance companies sometimes try to do this because their plans state benefits are different for out-of-network providers vs. emergency room visits.

2-When the Insurance Company processes your ER visit out of network, instead of In-Network

State law states that emergency room visits must be processed at the in-network benefit level. This means your insurance company cannot charge you more for emergency care received in a facility that is not part of their network.

3-When the Insurance Company denies the Emergency Room visit, stating the charges are Not Covered

When you first come to the emergency room, we quote your plan’s benefits to verify eligibility. There is no valid reason for your insurance company to deny payment in these cases as long as your premium payments are up to date.

4-The Insurance Company applies more to the patient than what they paid

Some insurances will apply a deductible to the claim, even though the benefits clearly state that the deductible does not apply to the ER visit.

5-If the patient had COVID-related testing, and the Insurance Company applied patient cost-share

Currently, the Insurance companies have waived patient cost-share. Additionally, according to the COVID Cares Act, there is no patient cost-share for the covid testing/encounter.

6-The insurance company processed the ER claim at an extremely low Allowable Amount, possibly at a Medicare Rate

Most benefit plans state that for Emergency Room visits, the Allowed Amount is a negotiated Rate. Some plans will have a third-party vendor reach out to negotiate the claim.

7-Insurance Company denied the ER claim for past timely filing

Some insurance companies try to deny payment based on technicalities. We submit proof that all claim information was submitted within the timely filing limit in these cases.

8-Insurance Company did not pay according to the contract on file

In these instances, we present a copy of the agreement to show that they did not pay according to the signed contract.

9-Insurance Company did not pay according to the Agreement that we signed with the 3rd party vendor

We will call and make the insurance company aware that we signed an agreement. Then, we will submit a copy of that agreement to the insurance provider.

If you’ve recently received a health insurance denial after a visit to one of Altus Emergency Centers, please get in touch with our patient advocate as soon as possible. We can help you submit an appeal.

Our Promise is to Always Help Find the Best Solutions in Benefit of our Patients

Get Peace of Mind, Call Patient Advocate

If you have any questions regarding your billing, please contact our Patient Advocate Department.

Lumberton & Waxahachie: Call us (469) 732-3151 between 8:00 am and 5:00 pm and ask for the Patient Advocate.

Baytown & Lake Jackson Call us (832) 241-5680 between 12:00 pm and 7:00 pm and ask for the Patient Advocate.